OK, How do you pay for it?

Review – What we have covered so far

This is the last blog in my series on tiny homes and tiny communities. I started back in September last year. I was motivated to produce evidence-based and grounded plans for people to navigate an increasingly volatile, uncertain, complex, and ambiguous world. (VUCA).

My overall design goals were to offer a ‘strategic doing’ community-based policy solution which could reduce Social inequality, provide care for a longer-living and growing elderly population, and reduce energy consumption impact on the planet.

As with most of my projects, this one grew and grew. So far, I’ve covered my design suggestions for shelter (the tiny home where I started), energy, food, transportation, environment, and communications. So, what began as a look at tiny homes or, more correctly – Auxillary Dwelling Units (ADUs in urban planning speak) turned into a roadmap for small communities. I’ve tried to devise a clever name for this vision, but nothing has shown up. I’ve even managed to stump chatGPT3 on this one.

I’m going with human-scale villages of the Future for now.

This blog focused on how these villages could be commercially developed and financed outside the traditional residential mortgage market.

The proposals

I have two primary, interconnected proposals for this financing issue. First and foremost, I believe it has to be motivated to foster well-being and the public good – not solely for profit. Second, I believe financing needs to combine public and private funding to balance short and long-term goals.

1. For the public good, not solely for profit (Can you say SillyCon Valley Bank?)

It is precedence for this type of investment financing. The CRA (Community Reinvestment Act), enacted in 1977, requires the Federal Reserve and other federal banking regulators to encourage financial institutions to help meet the credit needs of the communities where they do business, including low- and moderate-income (LMI) neighborhoods. I envision these new villages to be targeted for the LMI sector.

So, what exactly is community development finance? Financing community development investments in LMI communities often requires a creative mix of public, private, and philanthropic resources. The Federal Reserve helps community development organizations access the technical and financial resources needed to complete these often-complex deals. The Federal Reserve also uses its research and convening capabilities to explore new and emerging sources of capital to support community development finance.

2. Public – Private financing

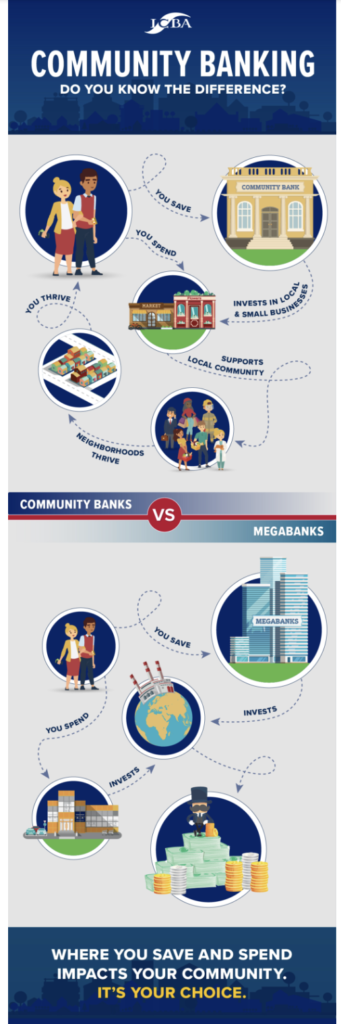

Community-owned banks, also known as cooperative banks, are financial institutions owned and managed by members of the local community. These banks provide various services, including checking and savings accounts, loans, mortgages, and investments. The profits generated by these banks are reinvested in the community, providing economic benefits to local businesses, citizens, and the overall economy.

Community-owned banks are committed to helping the local economy and creating a strong financial foundation for their members. They offer competitive interest rates on savings accounts and loans and strive to offer their customers the best products and services. In addition, they provide financial education and assistance to their members, helping them to make sound financial decisions.

Unlike large national banks, community-owned banks are not driven by profits alone. They are more likely to invest in local businesses and lend money to local community members. This helps keep money circulating in the local economy, which benefits both the bank and the community.

Why?

OK, all that aside, what are the advantages of the approach I’m suggesting?

1. Local Investment: Community-owned banks are typically locally owned and operated, which means the profits they generate are reinvested in the local economy. This helps to promote economic development and job growth in the community.

2. Personal Service: Community-owned banks typically provide more personalized service than larger national banks, as their staff is more invested in the local community and has a better understanding of the needs of their customers.

3. Responsible Lending: Community-owned banks are more likely to take a responsible approach to lend and often provide more flexible terms to borrowers, which can help them build a strong credit history.

4. Greater Access: Community-owned banks often provide more access to banking services for people who may not have access to traditional banking services, such as those in rural or low-income areas.

5. Higher Savings Rates: Because they are locally owned and operated, community-owned banks can often offer higher savings rates than larger, national banks. This can help people save more money and reach their financial goals faster.

Over the horizon

Phew! Well, there it is, a blueprint or roadmap for human sale communities of the Future. What now? My mission focus will now shift to education and evangelizing these design ideas. I’ll be looking for audiences that resonate with this message, potential development partners, and local actors focused on developing well-being.

Originally I had planned to cap off this blog series with an exposition of what I see as a paradigm-shifting local governance model. However, I’ve learned that that topic is worthy of a more lengthy exploration than a 1000-word blog.

Whether or not I pursue that project will depend on the responses I get from this series so far.

The journey down this rabbit hole has led me to two ideas: cooperatives and ‘sociocracies.’ The responses have been very positive to date, and I’ll let it sit into the Spring before I commit to moving that forward. As always, your input, thoughts, and critiques will be appreciated. But here is the teaser.

Buckle up, buttercup; it’s going to be an exciting ride.

Leave A Comment

You must be logged in to post a comment.